What are Futures Combo Bots?

Futures Combo Bots are automated trading tools designed to help users create and manage a portfolio of contracts according to specified ratios. These bots automatically adjust positions to maintain the preset proportions, even when market conditions change. This ensures the portfolio remains aligned with the user's strategy, offering enhanced operational efficiency and flexibility in various market conditions.

Please refer to Introduction to Futures Combo Bot for more details.

How do Futures Combo Bots work?

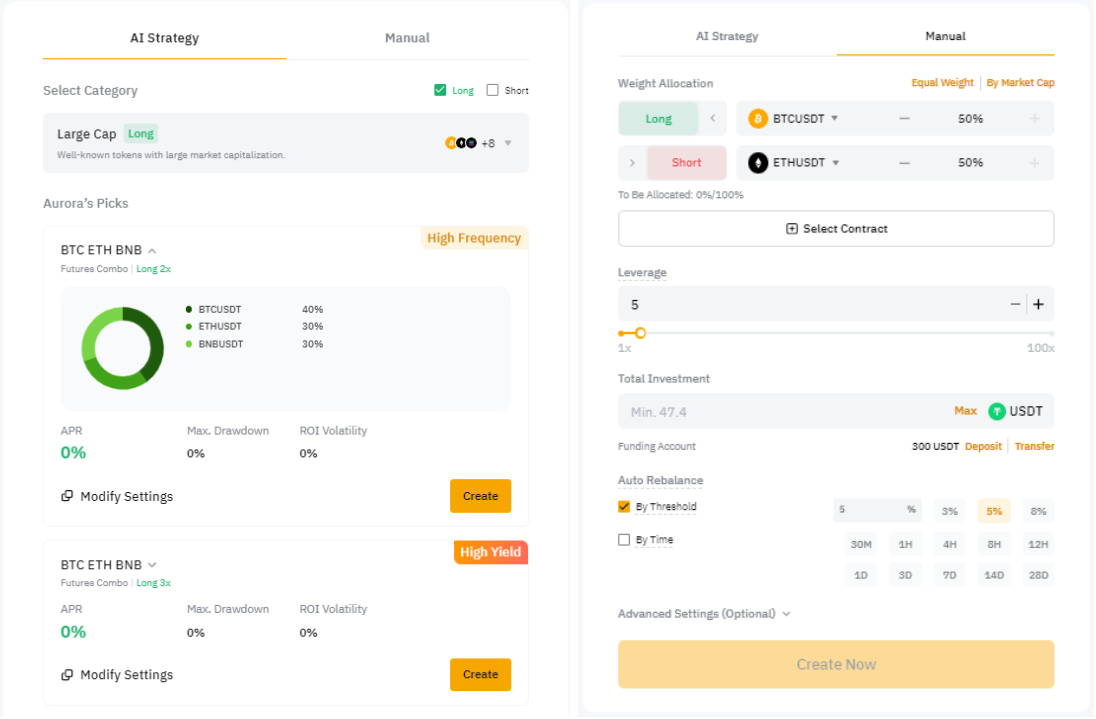

Futures Combo Bots allow users to create and manage a portfolio of contracts with a minimum of two (2) and up to 10 contracts. You can customize your portfolios by setting parameters, including contracts, position direction, position proportion (accurate to 1%), leverage, and rebalancing mechanisms (proportional threshold and/or time intervals). Additionally, orders can be placed using AI strategies for optimized trading decisions.

Example

- Allocation: BTCUSDT (Long, 30%) and ETHUSDT (Short, 70%)

- Leverage: 1x

- Rebalance Condition: 10% Deviation

- Investment: 100 USDT

When one of the contracts triggers a rebalance condition, the system will automatically rebalance the portfolio. For instance, if BTCUSDT hits 40% or falls below 20%, the system will trigger a rebalancing, reverting the allocation to BTCUSDT at 30% and ETHUSDT at 70%.

What kind of market is suitable for the Futures Combo Bot?

Futures Combo Bots can be adapted to various market conditions, offering a flexible approach to operating trading strategies.

Are there any fees associated with Futures Combo Bots?

The fee structure is the same as all other Derivatives trading on the Bybit platform. A funding fee will be received or paid at the funding fee interval for the contract traded. For more information on the funding fee interval, please visit here.

Which account do I use for Futures Combo Bot?

When you create a Futures Combo Bot, the system will automatically transfer the investment amount from your Funding Account.

Are there any Identity Verification requirements for Futures Combo Bot?

Identity Verification Lv. 1 or Business Verification is required. For more information on how to verify your account, please refer to How to Complete Individual Identity Verification.

For more information on the verification process, please refer to the following articles:

Are Futures Combo Bots supported on Subaccounts?

Yes, Futures Combo Bots are supported on Subaccounts.

How do I receive the profits generated from my Futures Combo Bot?

When the Futures Combo Bot is running, the profits will remain within the bot and be used as margin to increase your bot positions. Once the Futures Combo strategy is terminated, the funds will be automatically transferred from the user’s Trading Bot Account to the Funding Account.

Are there limits on the amount of investment for Futures Combo Bot?

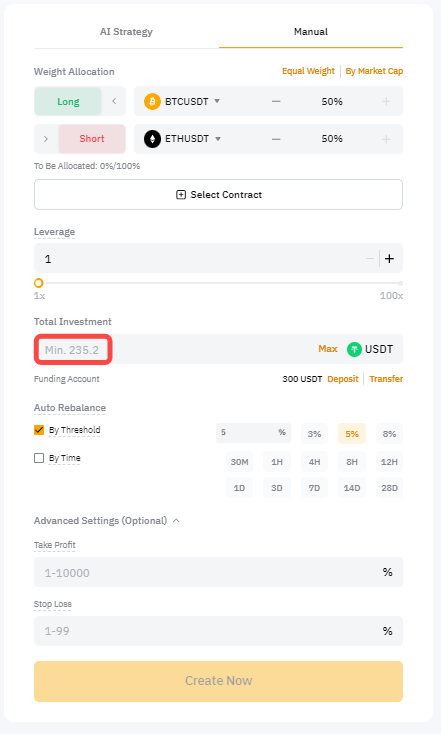

The investment amount limit can vary depending on the parameters set before the bot’s creation. The specific maximum and minimum investment amounts will be displayed in the Investment column based on these parameters.

Can I add more investment amount or withdraw funds for the Futures Combo bot?

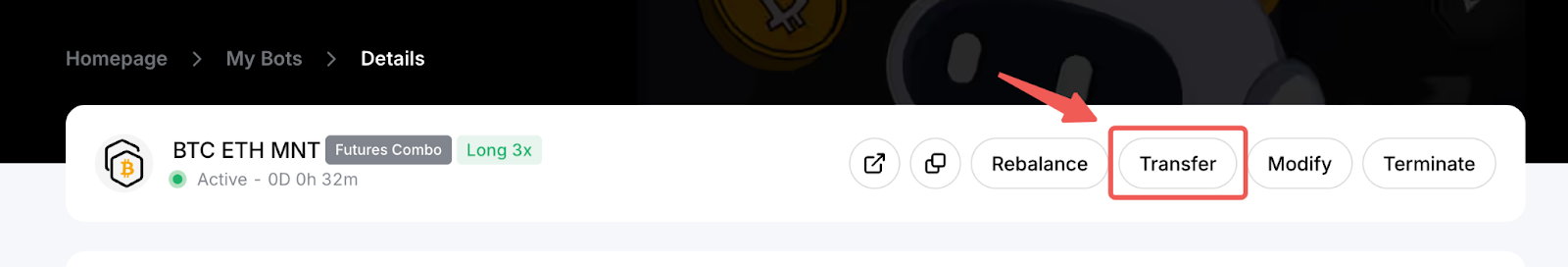

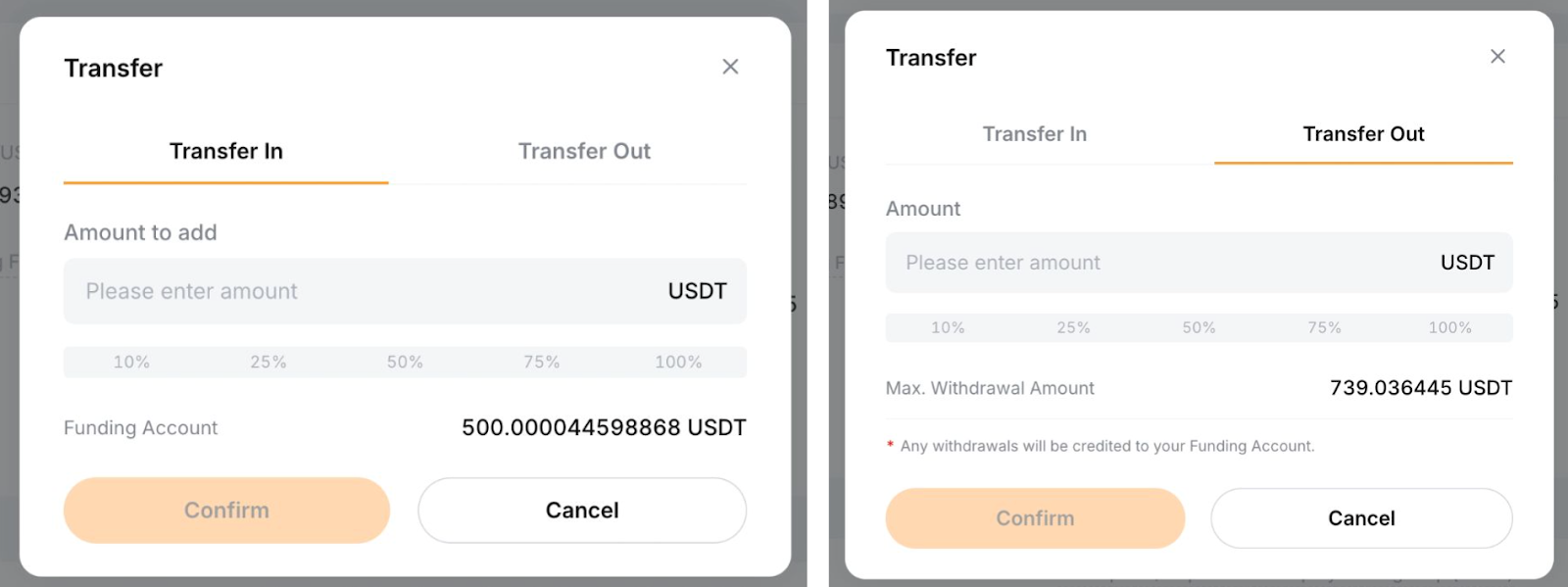

Yes, you can add or withdraw funds from your active Futures Combo bot by clicking on the Transfer button on the Bot Details page. Simply switch to the appropriate tab and set the amount details via the input field or the percentage bar before clicking on Confirm.

In the case of withdrawal, please note that the available withdrawable amount is directly proportional to your position’s P&L and may impact your position risk.

What happens during rebalancing if the value of one of the contracts in my portfolio is less than the minimum order size?

If the value of one of the contracts in your portfolio is less than the minimum order size during rebalancing, the system will handle it as follows:

Example 1: Adjusting below minimum order size

- Current Position Qty: 5 XYZ

- Minimum Order Qty: 1 XYZ

- Target Adjustment: 0.2 XYZ

The position will be adjusted to the minimum order size of 1 XYZ.

Example 2: Adjusting to an amount close to the minimum order size

- Current Position Qty: 5 XYZ

- Minimum Order Qty: 1 XYZ

- Target Adjustment: 4.2 XYZ

No adjustment will be made since the difference (5 − 4.2 = 0.8) between the current and target positions is less than the minimum order size.

From the above examples, if the difference between the current and target positions is greater than the minimum order size, the position will be adjusted to the minimum order size. Otherwise, if the difference between the current and target positions is less than the minimum order size, no adjustment will be made.

Can I adjust my Futures Combo Bot parameters?

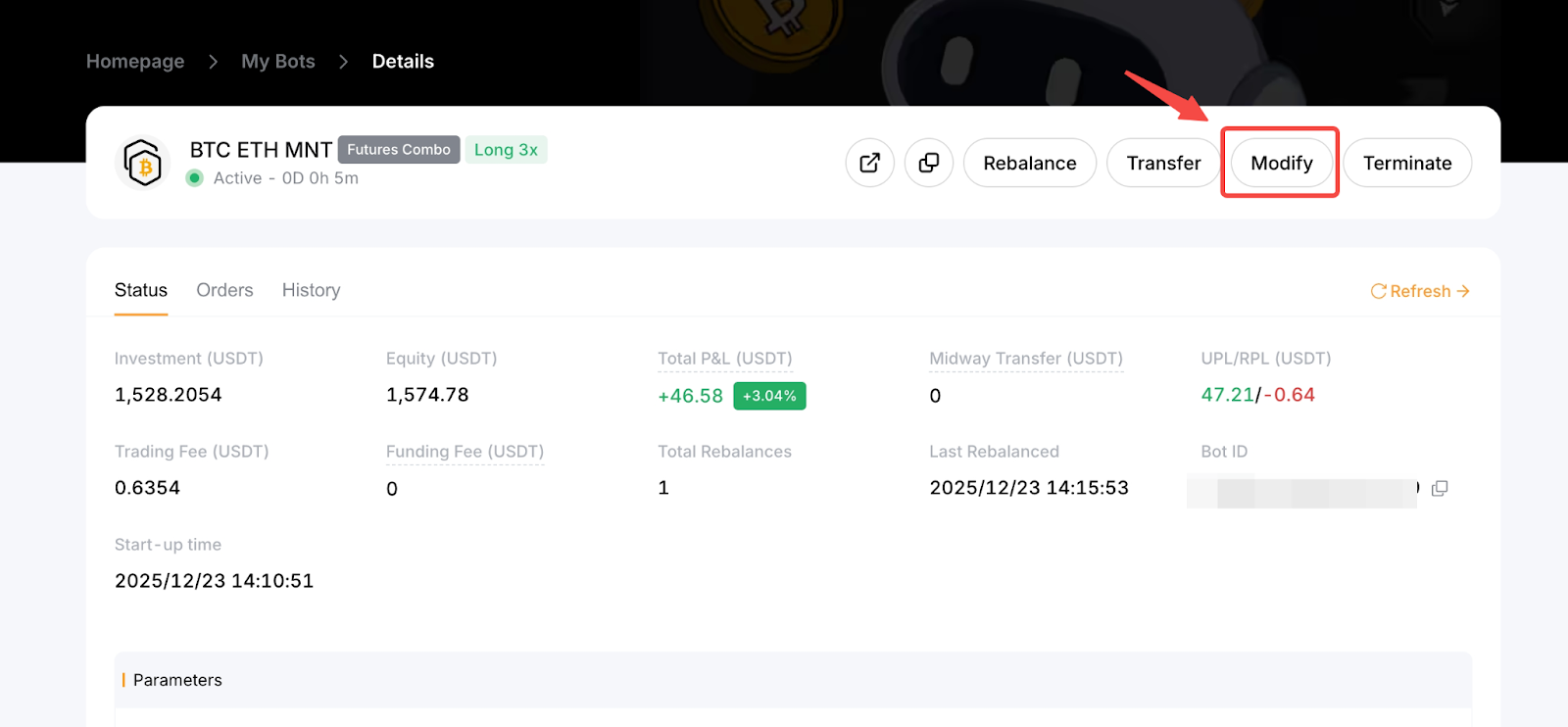

Yes. You can adjust the parameters of your running Futures Combo Bot via the Bot Details page. To start, go to View My Bots and find an active bot whose parameters you wish to adjust. Then click on Details → Modify.

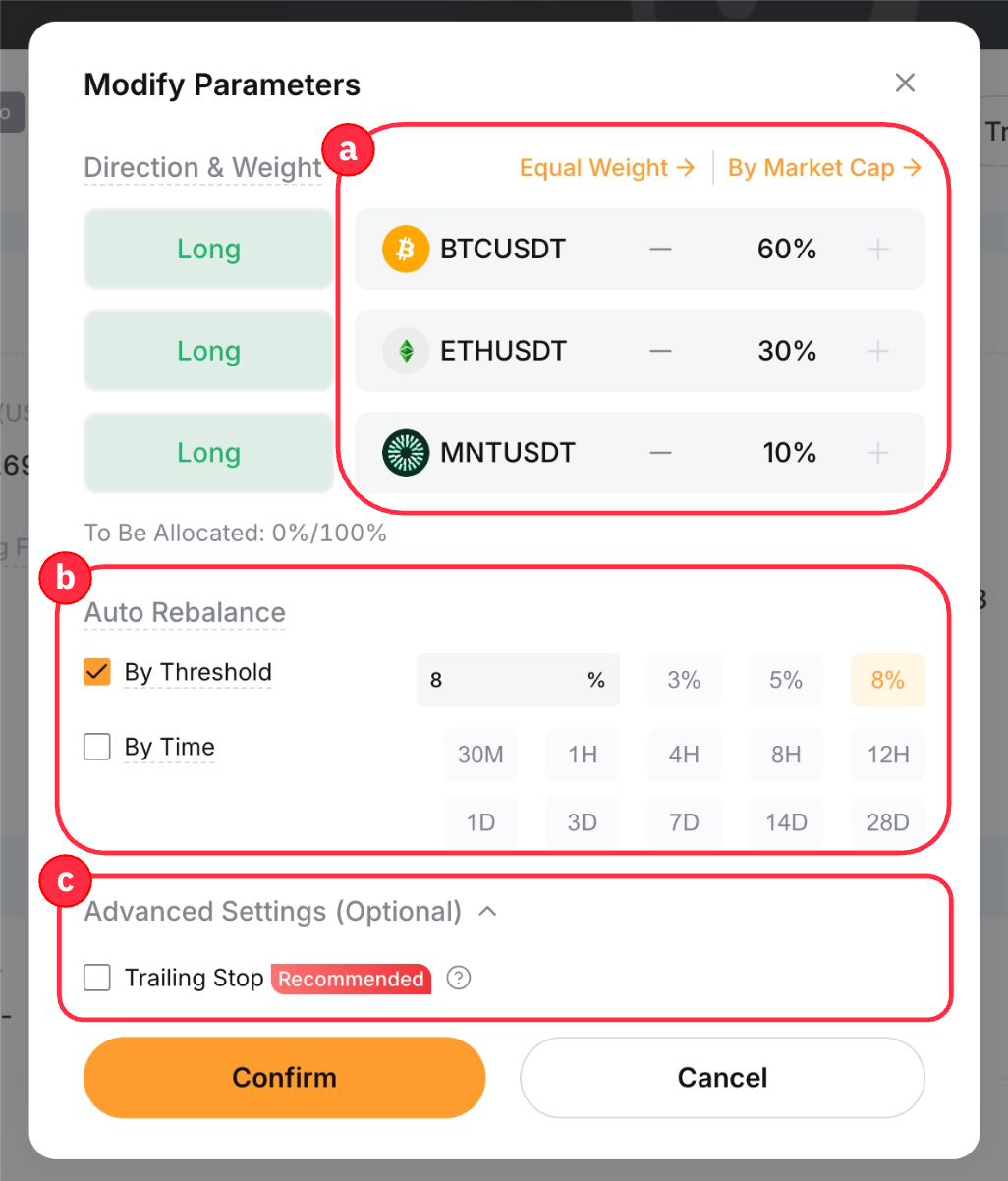

A pop-up window will appear, whereby you can adjust the following parameters:

- Set the proportion of your selected contracts either manually or by choosing the available preset options— by equal weight or by market cap.

- Modify the auto-rebalancing mechanism either by threshold or by a fixed time interval.

- Enable or adjust your Advanced Settings (i.e., Trailing Up and TP/SL).

Are there circumstances under which my Futures Combo Bot position can be liquidated?

Yes, your positions will be liquidated when the Maintenance Margin Rate (MMR) of the Futures Combo Bot has reached 100% or above.

Please note that the system will automatically terminate the bot and you will see the liquidation status message on the upper right corner of the bot details.

For more information, please refer to Trading Rules: Liquidation Process (Unified Trading Account).

Under what circumstances will rebalancing be triggered?

Rebalancing will be triggered under the following scenarios:

- The preset time interval for rebalancing is reached.

- The preset proportion threshold for rebalancing is touched.

- When the system allocates available balance and margin balance proportionally but cannot maintain the available balance at the preset ratio.

Under what circumstances will rebalancing fail?

Rebalancing will fail under the following scenarios:

1. The rebalancing order is less than the minimum notional value per order

2. The rebalancing order is less than the minimum order quantity,

3. The rebalancing order has exceeded the maximum order quantity,

4. The trading bot has reached its risk limit tier value.

For more information on order specification, kindly refer to the Derivatives Trading Parameters.

Under what risk limit tier is the Futures Combo Bot traded?

The Futures Combo Bot is traded within the first limit tier of the selected contracts. For instance, in the BTCUSDT Combo Bot, the maximum position value that can be opened is up to the first risk limit tier for BTCUSDT, which is 2,000,000 USDT. If the risk limit tier exceeds this threshold, the bot will halt placing new limit orders until the position is closed.

What happens if a certain contract in My Futures Combo Bot is delisted?

If a certain contract in your Futures Combo Bot is delisted, the entire bot will be automatically closed.

Where can I view the transfer records from Funding Account to Trading Bot or Vice Versa?

For more details, please refer to How to Get Started With Futures Combo Bot.

Can I use bonuses or vouchers in Futures Combo Bot?

Yes, Future Trading Bot bonuses and Loss Cover Vouchers are supported in Futures Combo Bot.

Under what circumstances will I receive notification messages?

You will receive notification messages via email in the following scenarios:

- When take-profit or stop-loss is triggered.

- When your Futures Combo Bot is close to being liquidated.

- When your Futures Combo Bot is liquidated.

- If any contract in your Futures Combo Bot is delisted.

Does the trading volume from Futures Combo Bots count toward the total Derivatives trading volume?

Yes, the trading volume from Futures Combo Bots is included in the total Derivatives trading volume.